If you have a Flexible Spending Account (FSA) through your employer, now is the time to put those funds toward your refractive surgery procedure with Dr. Andrew Holzman, board-certified corneal specialist, and Tysons Corner. When you use your FSA funds for the procedure, you are using pre-tax dollars. Depending on your tax bracket, the use of pre-tax dollars to pay for your refractive surgery procedure is anywhere from a 10-35% cost savings!

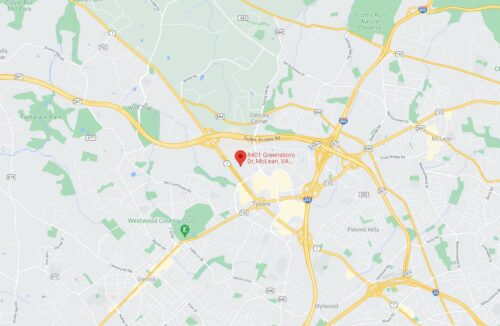

Right now, we are seeing two different kinds of FSA patients. The vast majority of patients coming into our brand new clinic located within the Hilton Worldwide Headquarters building are designating funds for use in 2012. They are trying to see if they are candidates now before enrolling in their 2012 FSA. Check with your HR department now to see when your open enrollment period is before it’s too late!

We are also seeing patients that have leftover 2011 FSA funds that they need to spend before the end of the year. Instead of buying another pair of glasses or more contacts, these patients want to use their funds for LASIK or PRK to lessen their reliance on these traditional forms of vision correction. If you have over-estimated your health expenses for 2011 and need to use your remaining funds, call us now for your consultation! Remember, FSA funds are “use it or lose it”.

One thing to keep in mind about FSA accounts is that the amount of money you can designate for these special accounts is expected to change over the next few years. In 2012, you can still set aside up to $5000 in your account. That is usually more than enough to cover your refractive surgery procedure with Dr. Holzman. In 2013, you can only set aside half as much money, or $2500, which can help you partially cover your procedure. Afterward, maximum amounts will be adjusted based on economic indicators.

Flexible spending accounts are a great way to save on your LASIK and PRK procedures. Don’t miss out!